Services

Choose The Service You'd Like More Information On

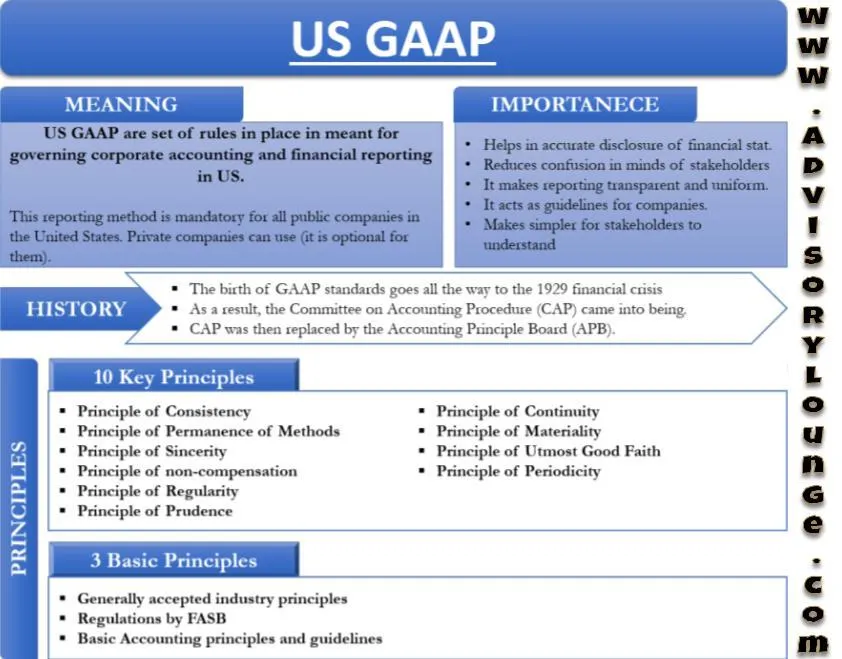

Accounting Services

Accurate, Insightful, and Tailored to Your Business Needs

At Advisory Lounge, our Accounting Services go far beyond number-crunching. We help businesses of all sizes maintain financial clarity, accuracy, and compliance while gaining deeper insight into their performance. From day-to-day accounts management to in-depth financial analysis and audit support, we deliver accurate, transparent, and actionable accounting solutions that empower smarter decision-making and sustainable growth.

Our Accounting Services are designed to give you full visibility into your business’s financial health. Whether you need ongoing financial management, audit support, or expert analysis for strategic planning, our team ensures that every number adds up—and that every report works for you.

We combine advanced accounting technology, decades of expertise, and personalized attention to help you maintain compliance, strengthen performance, and plan confidently for the future.

1. Financial Analysis

Your numbers tell a story—our job is to help you interpret it.

We evaluate your company’s financial performance to uncover opportunities for growth, efficiency, and profitability.

What’s Included

In-depth review of profitability, liquidity, and cash flow

Comparative analysis across periods to identify strengths and weaknesses

Benchmarking against industry averages

Break-even and margin analysis to pinpoint improvement areas

Detailed trend reporting and future performance forecasting

Customized action plans with measurable recommendations

✅ Result: You’ll gain a clear understanding of where your business stands financially—and exactly what steps to take next to reach your goals.

2. Audit Assistance

Preparing for an audit can be stressful, but with Advisory Lounge on your side, it doesn’t have to be.

We provide end-to-end support throughout the audit process to ensure accuracy, transparency, and confidence.

What’s Included

Review and preparation of all financial statements and supporting schedules

Organization of documentation for internal, external, or IRS audits

Communication and coordination with auditors or regulatory agencies

Pre-audit risk assessments and recommendations for improvement

Correction of discrepancies and documentation of internal controls

Post-audit review and follow-up reporting

✅ Result: Minimized disruptions, full compliance, and smoother audits that build trust with lenders, investors, and partners.

3. Accounts Payable & Receivable Management

Healthy cash flow starts with efficient payment management.

We take charge of your invoicing, collections, and disbursements to ensure money moves in and out of your business smoothly and on schedule.

What’s Included

Processing vendor invoices and ensuring timely payments

Managing client invoicing and tracking outstanding receivables

Reconciling accounts to identify and resolve discrepancies quickly

Maintaining accurate payment histories for reporting and tax preparation

Cash flow monitoring and forecasting based on inflows and outflows

Vendor and client communication to maintain strong relationships

✅ Result: Streamlined operations, improved liquidity, and better financial control—without missed payments or strained vendor relationships.

4. Debt Management

Smart debt management is key to maintaining financial stability and protecting your credit.

We help you strategically manage, restructure, or eliminate debt in ways that strengthen your financial position.

What’s Included

Review of all current loans, lines of credit, and obligations

Debt consolidation and restructuring recommendations

Negotiation assistance with creditors for better terms

Strategic repayment planning and interest reduction tactics

Cash-flow analysis to determine optimal payment schedules

Guidance on improving your business credit score and lender relationships

✅ Result: Reduced financial stress, optimized debt load, and a clear path toward long-term financial stability and growth.

🔹 Why Businesses Choose Advisory Lounge

** Experienced accountants and certified QuickBooks ProAdvisors

** Transparent, accurate, and timely financial reporting

** Personalized service with real human support—no AI-only automation

** Integration with bookkeeping, payroll, and CFO services

** Focus on clarity, compliance, and long-term profitability

🔹 Keep your finances organized, accurate, and audit-ready with the help of our expert accountants.

👉 Book Your Free Accounting Consultation

Let’s take your numbers from chaos to clarity—and your business from stable to thriving.

QuickBooks Services

setup, cleanup, and training - managed by certified quickbooks proadvisors

At Advisory Lounge, we specialize in QuickBooks setup, cleanup, and training—making sure your accounting system runs smoothly and accurately from day one. Whether you’re starting fresh, fixing existing records, or learning how to manage your books with confidence, our Certified QuickBooks ProAdvisors are here to help. We handle the setup, organization, and optimization of your QuickBooks account so you can focus on growing your business with reliable financial data at your fingertips.

Managing your business finances starts with having a well-organized accounting system. Our QuickBooks Services are designed to ensure your books are accurate, up-to-date, and tailored to your business operations. Whether you need a brand-new setup, a complete cleanup, or hands-on training, Advisory Lounge delivers expert support every step of the way.

1. QuickBooks Setup

Your financial system is only as good as its foundation. We set up your QuickBooks account from the ground up, ensuring that every detail matches your business’s structure and industry requirements.

What’s Included

** Selecting and configuring the right QuickBooks version (Online, Desktop, or Advanced)

** Setting up your Chart of Accounts to accurately reflect your revenue streams, expenses, and assets

** Integrating bank feeds, credit cards, and payment processors

** Customizing invoice templates, tax rates, and payroll settings

** Setting user permissions and security settings for your staff or accountant access

** Connecting apps and third-party integrations (POS systems, CRMs, inventory tools, etc.)

** Testing reports to ensure accurate balance sheets, income statements, and P&Ls

✅ Result: A fully functional QuickBooks system aligned to your exact business operations — ready for daily use, reconciliations, and reporting.

2. QuickBooks Cleanup

If your QuickBooks file is messy, outdated, or inaccurate, our cleanup service restores order and accuracy — ensuring your books reflect your true financial position.

What’s Included

** Reviewing your current QuickBooks file and identifying errors or inconsistencies

** Correcting misclassified transactions and duplicate entries

** Reconciling all bank, credit card, and loan accounts

** Adjusting opening balances and retained earnings to match your accountant’s reports

** Reviewing and correcting sales tax, vendor, and customer data

** Eliminating old or inactive accounts, vendors, and transactions

** Producing accurate year-to-date financial statements after cleanup

✅ Result: A clean, accurate QuickBooks file you can finally trust—ready for taxes, reporting, or financing.

3. QuickBooks Training

Knowledge is power, especially when it comes to your finances. Our customized QuickBooks training sessions are designed to empower you or your team with hands-on skills and confidence.

What’s Included

** One-on-one or group training (in-person or virtual)

** Step-by-step instruction on using the dashboard, invoices, and expense tracking

** Mastering bank reconciliation, financial reports, and budgets

** Training on inventory management, payroll processing, and tax tracking

** Tips for automation, efficiency, and error prevention

** Access to ongoing support and refresher sessions as your business grows

✅ Result: You’ll know exactly how to manage your QuickBooks system efficiently — and confidently make financial decisions backed by accurate data.

🔹 Why Businesses Choose Advisory Lounge

Certified QuickBooks ProAdvisors with years of accounting experience

Proven track record fixing and optimizing QuickBooks for hundreds of businesses nationwide

Seamless integration with bookkeeping, payroll, and tax services

Transparent pricing — no hourly surprises or hidden fees

Friendly, ongoing support whenever you need help

🔹 Whether you’re setting up QuickBooks for the first time, cleaning up old records, or just want to finally understand your financial reports — we’re here to help.

👉 Book a Free QuickBooks Consultation

and let’s make your accounting simple, clean, and 100% accurate.

Tax Services

Navigating Taxes, Bookkeeping, and Financial Planning Made Easy

Managing taxes, finances, and compliance requirements can be overwhelming, whether you're an individual or a business owner. Our comprehensive suite of services is designed to make the process as seamless as possible, ensuring that you not only remain compliant but also optimize your financial health for the future. We provide tailored solutions in tax preparation, advisory, and forecasting, along with bookkeeping and financial consulting to keep you on track.

Whether you need help with personal tax filing, business tax strategy, or year-round financial support, we offer expert services that are designed to simplify your life and help you achieve your financial goals. Explore the sections below to see how we can support your individual or business needs.

Below are the key features, categorized into two sections: CORPORATE SERVICES & INDIVIDUAL SERVICES

:Corporate Services:

key features

Business Tax Preparation & Filing

Description:

Our tax preparation services for businesses cover everything from filing corporate tax returns to managing multi-state tax obligations. We ensure your business stays compliant with corporate tax laws and that you optimize your tax savings.

Key Features:

Accurate filing of corporate returns (C-corp, S-corp, LLC, etc.)

Identification of business-specific deductions

Multi-state tax filings and reporting

Corporate Tax Advisory & Strategy

Description:

We work with business owners to develop strategies that minimize tax liabilities and enhance profitability. Our team takes a proactive approach to tax planning to identify opportunities for deductions, credits, and incentives.

Key Features:

Tax-saving strategies tailored to your industry

Advisory on mergers, acquisitions, and expansions

Optimization of R&D credits and other business incentives

Sales & Use Tax Management

Description:

Sales tax can be complicated, especially for multi-state businesses. Our service covers the proper collection, reporting, and remittance of sales taxes to ensure compliance and prevent penalties.

Key Features:

Sales tax registration and collection guidance

Multi-state tax compliance

Regular updates on changing sales tax laws

Employee Payroll Tax Compliance

Description:

We manage payroll tax compliance to ensure your business meets all federal, state, and local payroll tax obligations. From withholding to filing payroll tax returns, we handle it all so you can focus on running your business.

Key Features:

Payroll tax calculations and filing

Accurate reporting of employee wages and withholdings

Guidance on tax credits for employee retention

Tax Audit Support for Businesses

Description:

If your business faces a tax audit, we provide full representation to ensure your business complies with tax laws. We work directly with tax authorities and offer support throughout the audit process.

Key Features:

Comprehensive audit support

Assistance with IRS or state tax authority queries

Mitigation of penalties and interest

Tax Projection & Forecasting for Businesses

Description:

Just as individuals benefit from tax projections, businesses can use forecasting to plan for future tax obligations. Our team helps you predict tax liabilities based on projected income, expenses, and business growth.

Key Features:

Forward-looking tax projections for planning

Customized strategies based on business goals

Identifying tax-saving opportunities in future years

:Individual Services:

key features

Tax Preparation & Filing

Description:

We offer expert tax preparation services tailored to your unique financial situation. From income tax to deductions, our team ensures your personal tax filings are accurate, timely, and fully compliant with tax laws.

Key Features:

Maximization of deductions and credits

Accurate and timely filing of federal and state tax returns

Avoidance of common tax mistakes

Tax Advisory & Planning

Description:

Our tax advisors will work with you to create a tax strategy that minimizes your liabilities while maximizing your benefits. We provide personalized advice based on your financial goals, whether it's saving for retirement, purchasing a home, or other life events.

Key Features:

Tailored tax-saving strategies

Guidance on long-term financial planning

Annual tax review to ensure optimization

Tax Projection & Forecasting

Description:

We help you plan for the future by projecting your tax obligations for upcoming years. This proactive service allows you to adjust your financial strategies ahead of time to avoid surprises during tax season.

Key Features:

Year-over-year tax projections

Forecasting changes in income and expenses

Planning for life changes (e.g., marriage, children, retirement)

Personal Tax Compliance

Description:

Ensure your personal tax filings comply with all relevant laws. We handle the complexities of tax forms, deductions, and exemptions for you, so you don’t have to worry about staying up to date with changing regulations.

Key Features:

Compliance with local, state, and federal laws

Ongoing updates about tax code changes

Detailed documentation for transparency

Audit Representation

Description:

If you are selected for an IRS audit, we provide professional representation and support to guide you through the process, ensuring that you are fully prepared and your rights are protected.

Key Features:

Full representation in audits

Expert advice on handling audit requests

Ensuring minimal disruption to your life

New Business Start-Up

New Business Startup Services: Your Path to a Successful Launch

Starting a new business is an exciting adventure, but navigating the complexities of

legal, financial, and operational setup can often feel overwhelming.

At Advisory Lounge, we make it easier for entrepreneurs like you

to transform your ideas into a thriving business by providing expert guidance at every stage of the process,

ensuring your business is structured for success.

Our team of experienced professionals will work with you to ensure your business is built on a solid foundation,

with the right legal structure, financial setup, and tax strategies in place.

From business entity selection to operational setup, we’re here to support your entrepreneurial journey.

We provide personalized support to help you launch your business with confidence.

Schedule a free consultation today and let’s build your business the right way from day one!

Our Comprehensive New Business Startup Services Include:

Business Entity Selection: Choosing the right legal structure is crucial for your business’s success. We guide you through the pros and cons of LLC, S-Corp, C-Corp, and other entity types to ensure you make the best choice for your goals.

Registration and Compliance: We handle your business registration with state and federal authorities, ensuring compliance with all necessary regulations to keep your business legally sound and operational from day one.

EIN and Licensing: We assist in obtaining your Employer Identification Number (EIN) and securing any required business licenses, saving you time and avoiding potential roadblocks.

Business Banking and Financial Systems Setup: Get your business financials organized from the start. We’ll help you set up business banking accounts and implement reliable financial systems to track and manage your cash flow effectively.

QuickBooks Integration and Bookkeeping Setup: Streamline your financial management with QuickBooks integration. We set up your bookkeeping system to ensure accurate, easy-to-track finances, helping you avoid costly mistakes down the road.

Tax Planning and Compliance: Minimize your tax liability and stay compliant with federal and state regulations. Our expert tax strategies ensure that your business stays on top of tax filings and benefits from all available deductions.

Payroll Setup and Employee Classification: Setting up payroll correctly is essential to keeping your business compliant with labor laws. We’ll guide you through payroll setup and ensure proper employee classification (independent contractor vs. employee).

Financial Forecasting and Business Advisory: Grow with confidence. We provide insightful financial forecasting and expert business advice to help you plan for the future and scale efficiently.

Why Choose Advisory Lounge for Your New Business Startup?

Personalized Support: We offer tailored services that fit your unique needs, helping you launch with confidence and clarity.

Expert Guidance: Our team of experienced professionals is here to navigate the complexities of business setup, so you can focus on what you do best.

Comprehensive Services: We cover all aspects of business startup—from entity selection and tax planning to financial setup and advisory services.

Start Your Business Right from the Start

Starting a new business is a big step, but with the right guidance, you can ensure your success from day one.

Schedule a free consultation with us today and let’s work together to build a business that’s structured for growth, compliance, and long-term success.

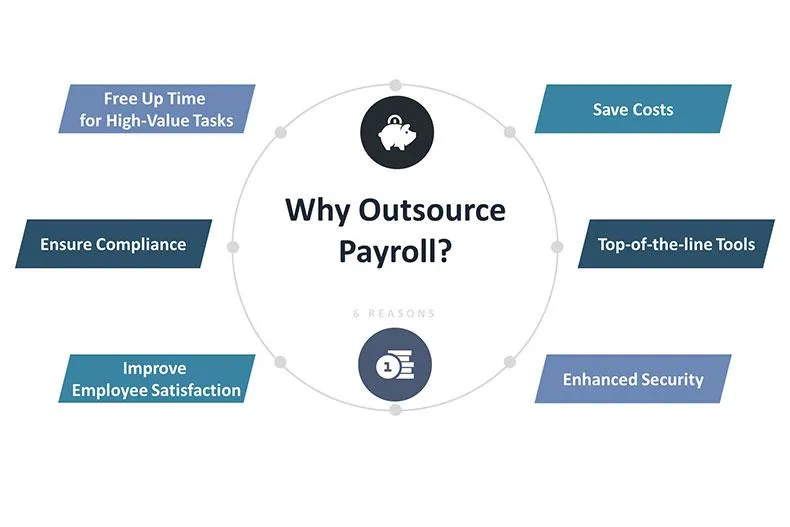

Payroll Services

accurate, compliant, and stress-free payroll — every time

Processing payroll shouldn’t be a weekly headache. At Advisory Lounge, we take the complexity out of paying your employees by offering fully managed payroll solutions that are accurate, compliant, and built to scale with your business. From employee onboarding and direct deposits to tax filings, garnishments, and year-end W-2s, we ensure every detail is handled with precision — so you can focus on running your business, not running payroll.

Our Payroll Services combine technology, compliance, and personalized support to simplify one of the most time-sensitive parts of your business operations.We work closely with business owners to ensure every payment, deduction, and filing is accurate, timely, and seamlessly integrated into your bookkeeping.

WHAT'S INCLUDED:

✅ Full Payroll Setup & Employee Onboarding

We start by setting up your payroll system properly — registering your business for all necessary federal, state, and local payroll tax accounts, entering employee information, and ensuring every detail (like withholdings, exemptions, and benefits) is correct from the start.

✅ Automated Payroll Processing

Whether you pay weekly, bi-weekly, or monthly, we handle all pay runs automatically — including gross-to-net calculations, overtime, commissions, and reimbursements — ensuring every employee is paid correctly and on time.

✅ Direct Deposits & Pay Stubs

We provide fast, secure direct deposits to your employees’ bank accounts, along with online access to digital pay stubs and detailed payment histories — all accessible through encrypted portals.

✅ Tax Withholding, Filing & Compliance

Our experts calculate, withhold, and remit all payroll taxes to federal, state, and local agencies. We prepare and file Form 941, 940, W-2s, W-3s, and 1099s, keeping you compliant year-round and audit-ready.

✅ Quarterly & Annual Payroll Reports

You’ll receive quarterly summaries and annual payroll reports showing total wages, tax liabilities, and benefits — making it easy to understand your company’s payroll trends and costs.

✅ Employee Benefits Administration

We can coordinate deductions and contributions for benefits such as health insurance, retirement plans, and FSA/HSA accounts — keeping everything accurate and synced with your bookkeeping.

✅ Time Tracking & Integration Support

We integrate your payroll system with time-tracking tools (like QuickBooks Time, Gusto, or ADP) to automate hours and reduce manual entry errors.

✅ Contractor & 1099 Payments

Need to pay vendors or freelancers? We manage contractor onboarding, payments, and 1099 preparation — ensuring compliance without extra work for you.

✅ Garnishments & Deductions Management

We handle wage garnishments, child support deductions, and other required withholdings in full compliance with court orders and state laws.

✅ Error Resolution & Support

Our team proactively monitors your payroll for discrepancies, late deposits, or missing filings — and resolves issues before they become costly penalties.

✅ Secure Cloud Storage & Data Protection

All payroll records are stored in encrypted, cloud-based systems with restricted access, ensuring complete confidentiality and compliance with data-protection standards.

WHY CHOOSE ADVISORY LOUNGE FOR PAYROLL:

🔹 Why Choose Advisory Lounge

Certified Payroll Experts: Every payroll run is reviewed by an experienced accountant.

Full Integration: Syncs seamlessly with your bookkeeping and QuickBooks accounts.

Tax-Time Ready: We keep your books clean and compliant for stress-free year-end filings.

Transparent Pricing: No per-employee or per-check fees — just flat-rate, predictable pricing.

Personalized Support: You get a dedicated payroll specialist who knows your business inside and out.

🔹 Ideal For

Small businesses looking to automate payroll and compliance

Startups with new employees or contractors

Growing companies needing payroll + bookkeeping integration

Employers seeking stress-free quarterly and year-end reporting

🔹 Add Payroll to Your Bookkeeping Plan

Combine our Done-For-You Bookkeeping with Payroll Services for a complete financial solution.

We’ll handle your books, pay your employees, and keep your business compliant — all under one roof.

👉 Book a Free Payroll Consultation

and get a customized quote tailored to your team and pay schedule.

Advisory & CFO Services

Strategic Financial Guidance for Sustainable Growth

At Advisory Lounge, our Advisory & CFO Services give you the financial leadership your business deserves—without the high cost of a full-time executive.

We go beyond bookkeeping to help you interpret your numbers, identify growth opportunities, and make confident, data-driven decisions.

From forecasting and budgeting to cash-flow management and strategic planning, we provide the clarity you need to grow with confidence.

Our fractional CFO and advisory services are designed for business owners who want deeper insight, proactive planning, and financial stability.

Whether you’re scaling a startup or optimizing an established operation, we act as your trusted financial partner, offering guidance that keeps your business agile, compliant, and profitable.

SEE WHAT'S INCLUDED BELOW:

✅ Financial Forecasting & Budgeting

We create detailed forecasts and rolling budgets that help you predict revenue, plan expenses, and prepare for both short-term goals and long-term growth.

✅ Cash-Flow & Liquidity Management

Gain visibility into your cash position with real-time analysis, cash-flow dashboards, and actionable strategies to maintain healthy liquidity year-round.

✅ Profitability & Margin Analysis

We identify which products, services, or clients generate the most profit—and where you can cut unnecessary costs to improve your bottom line.

✅ Break-Even & Scenario Modeling

We build flexible financial models that allow you to simulate “what-if” situations—so you can make informed decisions about pricing, hiring, or expansion.

✅ KPI Tracking & Performance Dashboards

We set up and monitor your key performance indicators (KPIs) monthly or quarterly, helping you visualize trends and measure your success at a glance.

✅ Business Valuation & Investment Readiness

Whether you’re seeking funding, attracting investors, or preparing to sell, we help assess your company’s value and strengthen your financial presentation.

✅ Cost Control & Expense Optimization

We review your recurring costs, vendor contracts, and operating expenses to uncover savings opportunities—without compromising quality or performance.

✅ Strategic Advisory & Decision Support

Receive actionable insights on expansion, restructuring, or major financial decisions. We bring clarity to complex financial choices so you can move forward confidently.

✅ Board & Stakeholder Reporting

We prepare professional, presentation-ready financial reports for investors, partners, and management—delivered in clear, easy-to-understand language.

✅ Monthly & Quarterly Advisory Sessions

We schedule regular strategy calls to review performance, discuss forecasts, and help you stay accountable to your financial goals.

🔹 Why Businesses Choose Advisory Lounge

Certified accountants with real-world business experience

Fractional CFO services tailored to your size and stage of growth

Integration with QuickBooks and cloud-based financial dashboards

Transparent pricing and dedicated advisor support

Proven results improving efficiency, cash flow, and profitability

🔹 Ready to gain control and clarity over your finances?

👉 Book Your Free CFO Consultation

Documents & Forms Preparation & Analysis

Accurate documentation is the backbone of every successful business

At Advisory Lounge, we provide comprehensive preparation, review, and analysis of essential business, tax, financial, and compliance documents to ensure your organization operates smoothly, remains compliant, and is positioned for growth.

Whether you’re a startup, established business, nonprofit, or contractor, we assist in organizing, filing, and interpreting a wide range of documentation across all core operational areas.

Our Services Cover:

(COMPLETE LIST IN FOLLOWING SECTION)

🧾 A) Tax Documents

From individual returns to corporate filings, we ensure your tax forms are accurate and compliant.

📋 B) Compliance & Legal Documents

Stay protected and meet all regulatory requirements with professionally prepared legal and internal business documents.

📚 C) Bookkeeping & Accounting Documents

Maintain clean, organized financial records that support day-to-day operations and long-term planning.

📈 D) Financial Statements & Reporting

Understand your financial position with clear, comprehensive reports and performance insights.

💼 E) Payroll Documents

Manage employee payments, taxes, and benefits with accurate payroll records and filings.

🔍 F) Advisory & Projection Documents

Make informed decisions using detailed forecasts, risk assessments, and financial analysis.

✅ Why Choose Advisory Lounge?

Accuracy & Compliance: We ensure every document meets legal and regulatory standards.

Strategic Insight: Our analysis goes beyond paperwork to provide valuable financial insights.

Customized Solutions: We tailor our services to meet your business’s unique structure and industry requirements.

Ready to take the guesswork out of your documentation?

Schedule a free consultation today and let our team handle the paperwork while you focus on growing your business.

A) Tax Documents

01) Form 1040 – Individual Income Tax Return

02) Form 1065 – Partnership Tax Return

03) Form 1120 – Corporate Tax Return

04) Form 1120S – S-Corporation Tax Return

05) Form 990 – Tax return for nonprofit organizations

06) Form 1099-NEC – Non-employee compensation for contractors

07) Form 1099-MISC – Miscellaneous income reporting

08) Form 1099-K – Payment transactions via third-party networks

09) Form W-2 – Employee Wage and Tax Statement

10) Form W-3 – Transmittal of Wage and Tax Statements

11) Form W-4 – Employee’s Withholding Certificate

12) Form W-9 – Request for Taxpayer Identification Number (TIN)

13) Form 941 – Employer’s Quarterly Federal Tax Return

14) Form 944 – Employer’s Annual Federal Tax Return

15) Form 940 – Employer’s Annual Federal Unemployment (FUTA) Tax Return

16) Form 1095-C – Employer-Provided Health Insurance Offer and Coverage

17) State-Specific Franchise Tax Filings - Taxes levied by some states on business revenue or net worth, often required annually.

B) Compliance & Legal Documents

01) Internal Control Reports – Ensures financial accuracy and fraud prevention

02) SOC (Service Organization Control) Reports – For security and compliance verification

03) ESG (Environmental, Social, and Governance) Reports – Sustainability and corporate responsibility financials

04) Business License and Registration Documents – Includes IRS, state, or local filings

05) Bank Loan Covenants Compliance Reports – Ensures businesses meet lender financial requirements

06) State & Federal Labor Law Compliance Forms – Compliance for employee regulations

07) Sales Tax Reports & Filings – Documentation for state tax authorities

08) Operating Manual - Guides business operations and internal procedures.

09) Business Continuity Plan - Ensures business functions continue during and after disruptions.

10) Employee Handbook - Outlines company policies, benefits, and employee expectations.

11) Non-Disclosure Agreements (NDAs) - Ensures confidentiality when sharing sensitive information.

12) NCNDA (Non-Circumvention, Non-Disclosure Agreement) - Prevents bypassing & protects confidential information from unauthorized use.

13) Partnership Agreements - Defines terms, roles, and profit-sharing among business partners.

C) Bookkeeping & Accounting Documents

01) General Ledger – Master record of all financial transactions

02) Trial Balance – List of all general ledger accounts with balances

03) Chart of Accounts – List of all accounts used in the business financials

04) Fixed Asset Registers – Tracks company-owned assets, depreciation, and disposals

05) Accounts Payable (AP) Reports – Outstanding vendor payments

06) Accounts Receivable (AR) Reports – Customer invoices and collections

07) Bank Reconciliation Statements – Verification of financial records against bank statements

08) Accrued Expenses Schedule – List of unpaid but incurred expenses

09) Prepaid Expense Schedule – Tracks expenses paid in advance

10) Inventory Valuation Report - Value of stock on hand

11) Cost Optimization Analysis - Identifies cost-saving opportunities to improve financial efficiency.

12) Vendor/Customer Statements - Summarizes transactions with vendors or customers, showing balances and payments.

D) Financial Statements & Reporting

01) Income Statement (Profit & Loss Statement) – Reports revenue and expenses

02) Balance Sheet – Summarizes assets, liabilities, and equity

03) Cash Flow Statement – Tracks cash movement in and out of the business

04) Owner’s Equity Statement – Shows changes in equity accounts

05) Budget vs. Actual Reports – Compares financial performance against budgeted goals

06) Debt Schedule – Details of business loans, credit obligations, and repayment terms

07) Strategic Growth Plan Projections - Long-term financial forecasts for revenue growth, new markets, or product lines.

08) Investment Return Projections - Estimates of potential returns from investments based on market conditions and risk.

E) Payroll Documents

01) Payroll Registers – Lists employee wages, deductions, and taxes

02) Payroll Tax Filings – Forms submitted to tax agencies for payroll taxes

03) Employee Pay Stubs – Records of earnings and withholdings

04) Time & Attendance Reports – Tracks employee work hours

05) Workers’ Compensation Reports – Documents related to worker claims and employer liability

06) Employee Benefit Statements - Outlines employee benefits such as insurance, retirement contributions, etc.

07) Bonus & Commission Reports - Details of employee bonuses or commissions based on performance.

F) Advisory & Projection Documents

01) Financial Projections & Forecasts – Estimates of future financial performance

02) Cash Flow Projections – Expected cash inflows and outflows

03) Break-Even Analysis – Determines when a business becomes profitable

04) Risk Assessment Reports – Identifies financial and operational risks

05) Cost-Benefit Analysis Reports – Evaluates financial impact of decisions

06) Economic Impact Studies – Evaluates business decisions on overall market trends

07) KPI Benchmarking Reports – Compares business performance against industry benchmarks

08) Supply Chain Cost Analysis – Evaluates vendor, logistics, and inventory costs

09) Working Capital Efficiency Reports – Measures business liquidity and operational efficiency

FOR MORE INFORMATION REQUEST YOUR FREE CONSULTATION

Integrity

We prioritize transparency & honesty, offering advice that serves our clients' best interests.

Collaboration

Working with clients to understand their needs & create tailored strategies for lasting success.

Empowerment

Providing Clients with the knowledge, tools, & strategies to make informed decisions & take control.

Excellence

Delivering top-notch service by continuously improving & staying current with all changes.

Innovation

Embracing new ideas & technologies to create innovative solutions for growth & efficiency.

COMPANY

© 2022 Advisory Lounge - All Rights Reserved